New Food Store in Gainsborough

Lincolnshire Co-op has opened its a food store in Gainsborough today, bringing a range of valued services to the local are...

Read MorePlease note this article was published on 23rd March and may not contain all the latest information

The Covid-19 Coronavirus is causing chaos across the country, with many working from home and businesses forced to temporarily close down.

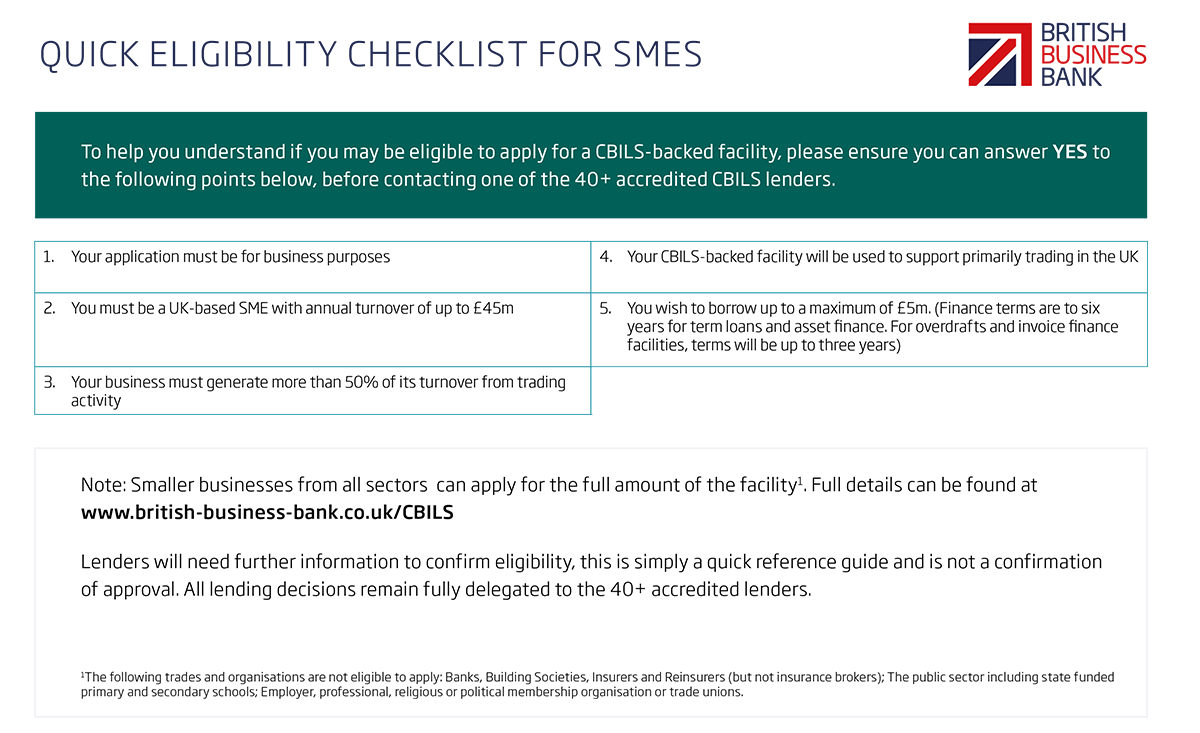

CBILS is a new scheme that can provide facilities of up to £5m for SMEs who are experiencing lost or deferred revenues, leading to disruptions to their cashflow. CBILS supports a wide range of business finance products, including term loans, overdrafts, invoice finance and asset finance facilities.

This scheme is now live and provided by the British Business Bank through participating providers. All 40+ accredited lenders will be ready to provide CBILS today (23rd March 2020).

Click here to find out more about this scheme and apply.

Lincolnshire Co-op has opened its a food store in Gainsborough today, bringing a range of valued services to the local are...

Read MoreThe Great British Food Awards celebrate the country's finest home-grown ingredients and artisanal produce, as well as the har...

Read MoreLog into your account